How Republicans Are Secretly Raising YOUR Taxes!

How Republicans Are Secretly Raising YOUR Taxes!

by Benjamin T. Moore, Jr.

Back in 1776 this nation – to be – fought a little war. You might have heard about it. It was called “The Revolutionary War.” A little upstart Colony shed blood to separate and break away from the greatest “superpower” the world had seen at that time. Great Britain.

There were many reasons for this, but the prevailing expressed reason had to do with “taxation without representation.” On the surface, this is a slogan that is easily remembered and understood. Say it a few times. Notice how it rolls off the tongue. It is almost rhythmic like a chant. “Taxation Without Representation.”

When you actually consider things, representation doesn’t mean you get what you want or that things will go your way. Growing up, I was represented and present at many family decisions. I did NOT get my way.

Who does really get their way? As a child, I thought adults always got their way. I look back now and laugh. The point is, when you study history, you find that many of the “founding fathers” spent quite a bit of time in Europe representing the issues and concerns of our fledgling colony. Evidently, they did not get what they wanted. One might suspect the real issues that lead to the Revolutionary War had little to do with taxation, but taxation was a useful meme for galvanizing public sentiment against Britain.

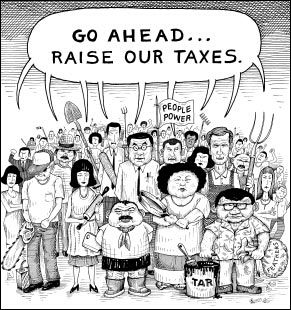

This meme is still being used today to herd the unthinking in the direction beneficial to those who own the Republican party. The question? Is this any more accurate today than it was in 1776?

ALL governments, good or oppressive collect revenues from the citizens they rule over. This has been a fact since humans bought into the idea that having a person – tribal chieftain or king – rule over them and organize the collective effort, was a good idea. People have been complaining and seeking to avoid paying taxes ever since.

A tax is the taking of a portion of the wealth of the citizen. We’ve refined that process to the point we are now paying taxes we are not even aware we’re paying. Many taxes are simply passed along in the prices of the goods and services we purchase. Because they are a part of the price, we don’t perceive them as taxes, yet we pay them without a whimper. This phenomena has not gone unnoticed.

The Republicans have been raising your taxes at a staggering rate without your notice. They use two primary tools to accomplish their theft. They are, “Privatization” and “Deregulation.”

How does this work? Our government is not in the business of turning a profit. It is a “not-for-profit” institution. The taxes the government collects, whether you believe them to be mismanaged, depending on a certain administration, still go to support the collective common good. If you are old enough, when you went to school there were no textbook rental fees. Paper and pencils were supplied to each student. The only thing I paid for was my lunch on the few days I didn’t bring it with me. Teachers were respected and taught well in an environment conducive to learning. This was all paid for by taxes.

Over the years they’ve been defunding our educational system. We now see the goal was to move everyone to a charter school model where parents pay tuition. Notice, your taxes never went down. Now you’re being forced to totally shoulder the cost for educating your children. Is this a tax? You cannot simply opt out of sending your children to school. That’s against the law. So, yes you’re now being forced to pay more. Vouchers from the State do not cover the costs. So, the Republican attack on education is a hidden tax.

Do you have representation? Charter Schools are privately owned corporate entities. You really do not have representation. This is the definition of taxation without representation. I’ve given one example of how privatization affects many people.

Privatization is not limited to our educational system. Utility companies, hospitals, the TSA, privatization is happening all around us. Most people know something is terribly wrong with our country. What they fail to realize is that when patriotism was at it’s highest, when people felt the most optimistic about their opportunity to fulfill the “American Dream” was when our government was exercising control and collecting higher taxes, much higher than the tax rates of today.

The other poison pill of the Republican agenda is Deregulation. The theory goes, corporations are so loaded down with regulations and red tape they cannot be as profitable as their competitors around the globe. In order to make the moves and the profits they must get rid of regulations. In essence this is a race to the bottom. Our companies can easily make products as cheap as the Chinese.

There are rivers in China that are filled with toxic sludge. China has to purchase drinking water from other nations. The quality of their products are substandard. Some have been fatal. Remember our experience with dog food imported from China? How about the lead in children’s toys or that toxic toothpaste they were exporting? These are the results of a lack of regulation.

The BP oil spill was the result of a lack of regulation. All those people affected by that oil spill? The ones who lost their businesses or that saw their profits drop? That was a tax levied upon them by Republican policy. Wealth was forcibly transferred from them, their families and the futures of their children. Did they have representation?

Do you have a pension? Do you own a 401k? Have you checked it’s value lately? Chances are, it has taken quite a hit. This is the direct effect of the Republican policy of deregulating the Banks and the Stock Market. The money you and your family have lost is a tax. The wealth was transferred from you into the pockets of millionaires and billionaires. Did you have representation? That is a tax. Republicans won’t call these taxes. They want you to focus on money paid to our Government for the common good. This money is managed by people you get to vote in or out of office every two years.

When Jamie Dimon of J.P. Morgan Chase announced a couple of weeks ago that Chase Bank had lost – now – 4 billion dollars on the same type of bet Banks and the Stock Market were making just prior to our near financial melt down of 2008, my portfolio took a 100 thousand dollar hit. Now that was one helluva tax! You may have fared better. However, chances are if you’ve got a 401k or a pension you have some Chase stock in it as well. You just paid taxes without representation.